The second edition of the report, once again provides an overview of BNP Paribas Wealth Management's in-house evaluation methodologies which analyse the level of responsibility of financial instruments recommended to our clients.

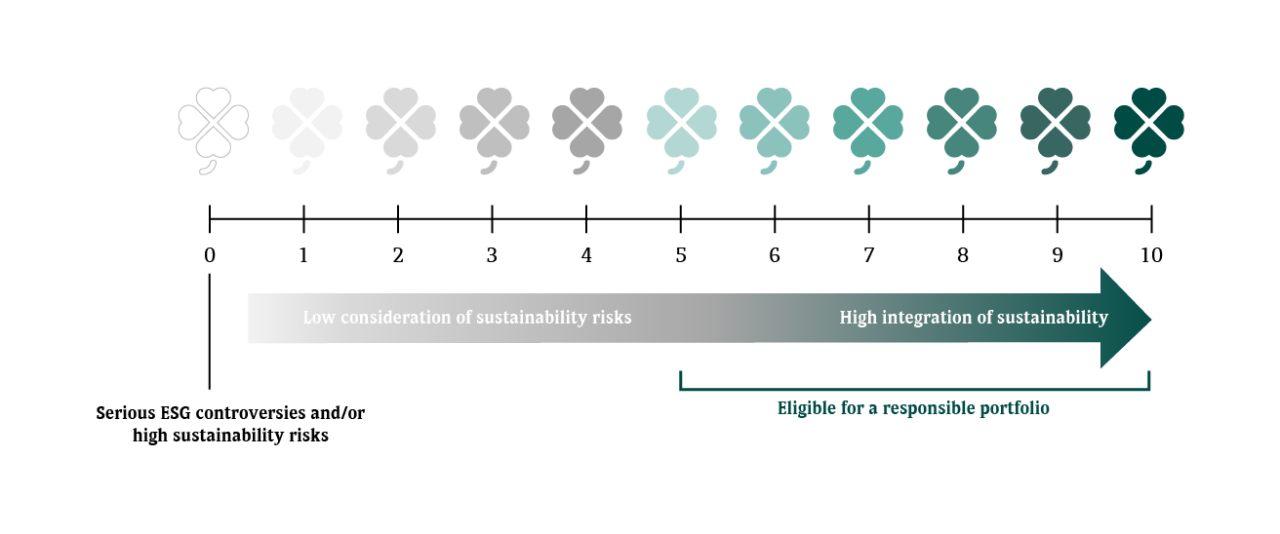

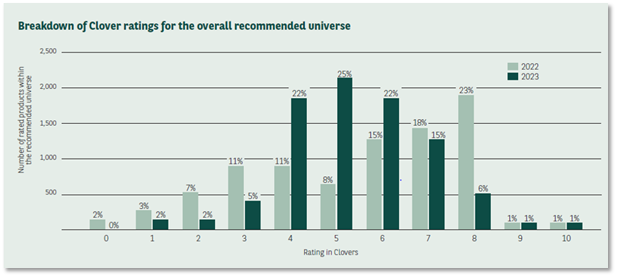

The evaluation helps to position all financial instruments recommended by BNP Paribas Wealth Management on a scale of 0 to 10 Clovers, within each asset class, whether the products are responsible or not.

Since the evaluation was created in 2010, it has been adapted to the growing consideration of sustainable development issues in the economy, the transition of the financial sector towards sustainable finance and related regulations.

Contents of the 2023 Clover Report

As for the previous edition, the 2023 Clover report was audited by Deloitte, attesting to the robustness and proper application of our Clover methodology. This verification resulted in the production of a document appearing at the end of the report.

Our Clover evaluation is one of the cornerstones of our Responsible Invesmtent approach.

Regardless of management solutions (execution only, advisory management or discretionary portfolio management), we offer our clients a wide range of financial instruments integrating varying levels of sustainability. In countries subject to and in compliance with European regulations on sustainable finance, when it comes to the construction process of discretionary portfolios and investment offers in advisory services, products are first selected on the basis of client ESG preferences and regulatory information provided by asset management companies. The Clover evalutaion finally provides additional insights into the level of responsibility of the identified products.

Clients then choose appropriate investment options to match their objectives of expectations of Return on Investment, level of risk and sustainability preferences.

We were delighted and honoured to receive this accolade, which once again reflects the considerable efforts we have made in this area. In 2024, we will continue to offer advice to our clients and share with them our responsible investment expertise so that, thanks to our adapted investment offer, they can decide to contribute to a more sustainable future.

Éléonore Bedel

Chief Sustainability Officer

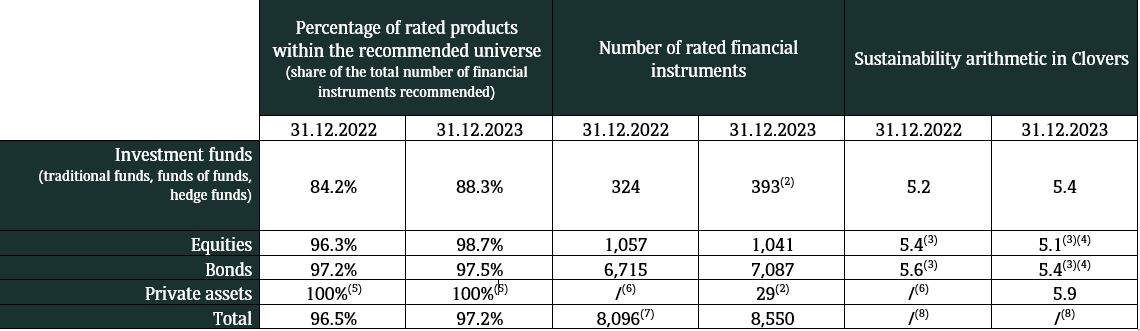

(1) In 2023, changes were made to the method of converting the score of issuers out of a 100 (received from BNP Paribas Asset Management) into Clovers in order to be more aligned with BNP Paribas Asset Management. The conversion is no longer made into a percentile, according to a defined correlation table, but rather into dozens. Hence, a score of 56/100 is now equal to five Clovers.

(2) In 2023, two open-ended private asset funds showing the characteristics of a long-only fund were rated according to the evaluation methodology of long-only funds. The two funds are therefore counted along with other rated traditional funds. An open-ended fund allows the purchase of securities at any time, which is not the case for closed-ended funds.

(3) The arithmetic average expressed in Clovers for equities and corporate bonds is provided for indicative purposes as each Clover rating is linked to the peer group of each company (sector and region of activity).

(4) The changes made to the issuer rating methodology in 2023 partly explain the evolution of the arithmetic average in Clovers for equities and bonds between end-2022 and end-2023.

(5) The number of products rated by the Clover methodology for private assets corresponds to the funds launched since 1 January 2022, i.e. the implementation of the methodology for this asset class (except for open-ended funds showing characteristics of long-only funds).

(6) At end-2022, the total number of private assets rated and the associated arithmetic average in Clovers were not published as the methodology was recent.

(7) As the number of rated private assets as at end-2022 was not published in the previous report, the total number does not include this asset class.

(8) As the methodologies assessing the responsibility level of recommended assets differ according to the asset class, an arithmetic average across all asset classes is not relevant in this table.

(9) GSS bonds can be rated more than eight Clovers, depending on the quality of the underlying project(s).