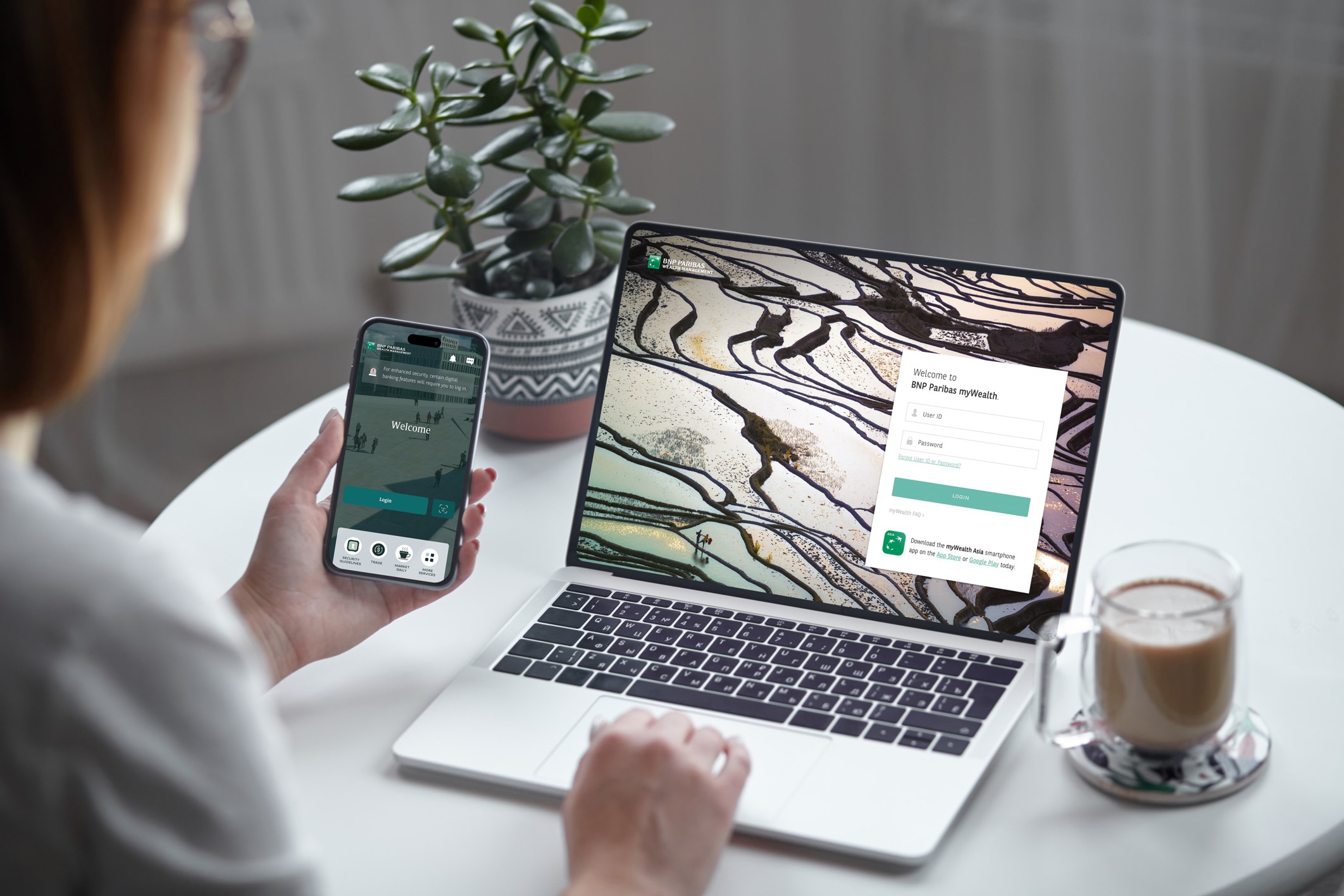

myWealth is a dedicated digital banking platform to help make your banking experience as smooth and convenient as possible through…

A secured mobile experience

Experience communicating through myWealth Chat and integrated platforms, all designed to enhance your wealth management experience.

Getting a holistic portfolio overview

From order placements to financial queries, connect effortlessly with your relationship manager to assist with your wealth management needs.

Going paperless with e-statements & documents

Providing you a peace of mind and confidence, knowing that your chats are safe and secure.

Staying up to date with market news

Explore research publications from our Equity Research specialist or view curated news related to your portfolio.

Trading on-the-go across global exchanges

Trade across major exchanges in Asia, North America, and Europe with real-time notifications and convenient order management.

Personalised portfolio advice

Exclusively available to MyAdvisory clients, receive tailor-made recommendations sent directly to your smartphone weekly.

Log in to myWealth online or download the mobile app in your smartphone now!

Get it on

Google Play

Get it on

App Store